Description

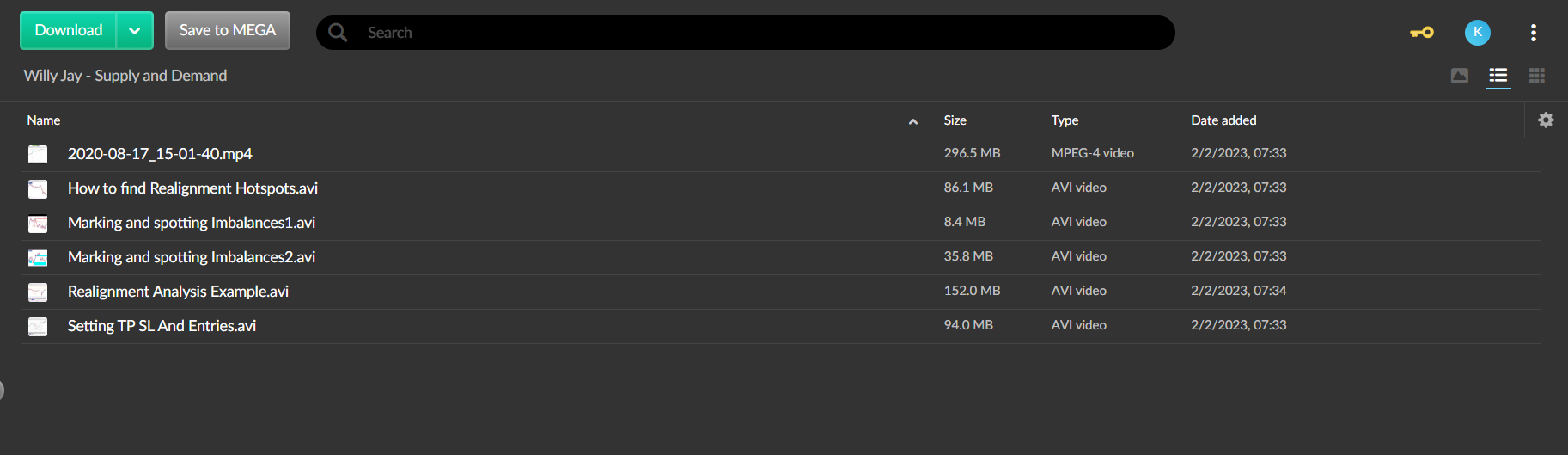

Download Willy Jay – Supply and Demand (672.7 MB) as proof.

Willy Jay – What is available and what people want.

A Different Perspective on How to Unlock Low-Risk, High-Reward Trading at Market Turning Points

Introduction: Challenges the Traditional Wisdom:

Many mentors and institutions focus on lagging indicators and chart patterns in Forex trading. But a different approach, often called the “expensive truth,” is different from the norm. This approach, which is based on Wall Street wisdom, focuses on trading at market turning points. This methodology taps into the psychology of big banks and offers a strategic advantage for retail traders.

The problem with novice traders:

A common mistake made by novice traders is to sell in a bullish long-term market. This counterintuitive behavior comes from being taught by mentors to buy after an uptrend and sell after a downtrend. This way of trading is different from how big banks trade, which shows a problem with how people learn to trade.

The way we analyze things from the top down:

To fix this problem, it’s best to do a top-down analysis. Instead of looking at things from the bottom up, looking at things from a bigger picture gives better clues about where the market is going. This methodology is more in line with the trading strategies used by major financial institutions.

Study of anticipating changes in the market:

The analysis at the beginning of August 2021 shows how effective this approach is. By using order flow analysis, the trader found key locations where major banks had previously traded. The trader correctly predicted that price would continue its downtrend in August. This strategy helped the trader catch the lowest price in August 2021, which shows how important it is to think and trade like a bank.

Beyond the Market Structure: Uncovering the 29% of the market:

To be successful in order flow trading, you need to know more than just how the market works, which is only 29% of the analysis. It’s important to figure out where people want to buy and sell things in the market. But not all RBDs offer the same chances for trading. The key is to choose the RBD at the right location, away from opposing zones, to ensure a low-risk trading opportunity.

Thinking about Success in Forex Trading:

This way of trading Forex is different from usual methods. It focuses on important moments in the market, similar to how big financial institutions think and plan. Trading at specific locations with low risks and high rewards, supported by analysis of order flow, is a unique advantage for retail traders. The conclusion asks readers to give their email addresses for updates, hinting at a commitment to ongoing education and a promise of safe and secure course materials delivered via a MEGA download link.

Reviews

There are no reviews yet.